“Metaverse Meltdown: Is Your Virtual Fortune Vanishing? Unveiling the Shocking Truth Behind Depreciating Metaverse Properties! Don’t Miss Out on the Rise and Fall of Digital Riches!”

Metaverse Property Market Shaken: Examining the Depreciation of Popular Metaverse Properties

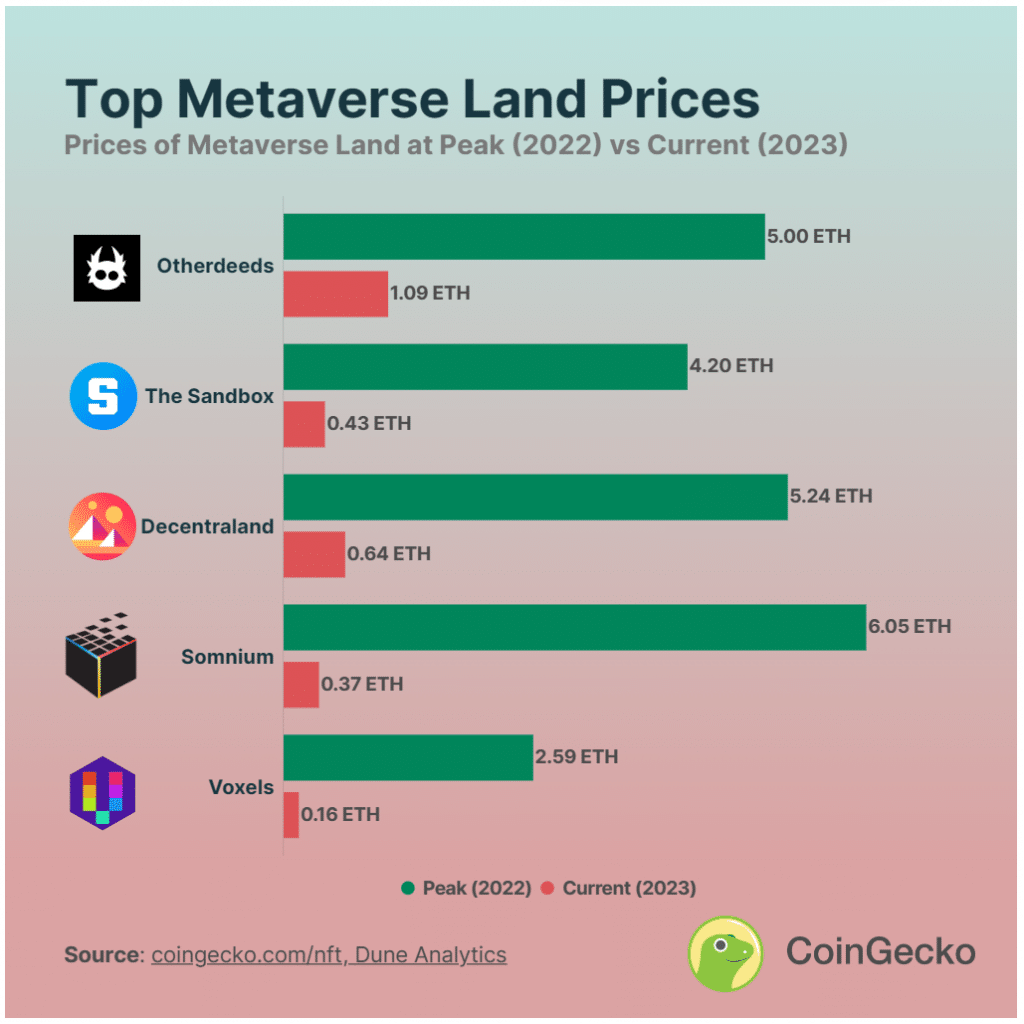

As the metaverse continues to capture the imagination of technology enthusiasts, its property market is facing a significant challenge. Well-known metaverse properties such as Otherdeeds, The Sandbox, Decentraland, Somnium, and Voxels have experienced a wave of depreciation, raising concerns about the stability and investment potential of the metaverse property market. In this article, we will delve into the reasons behind the decline in value, analyze the percentage decrease, and explore the broader implications for the future of the metaverse property market.

The Devaluation of Metaverse Properties

The metaverse property market has witnessed a significant devaluation, with popular properties facing substantial losses. Otherdeeds, once a prominent player, has suffered a drastic drop in value, selling properties for 5 Ether (ETH) at its peak but now struggling to command 1.09 ETH, representing a notable decline of 78.2%. The Sandbox and Decentraland properties have experienced substantial declines as well, with 89.76% and 87.88% losses respectively. Voxels and Somnium faced an alarming 93.8% loss, raising concerns about their future.

Exploring the Factors behind the Depreciation

Several factors have contributed to the depreciation of metaverse properties. Market oversaturation and speculative hype have created an inflated bubble that is now bursting. The lack of real-world utility and limited demand for virtual properties have also played a role. Additionally, emerging competition and shifting user preferences within the metaverse landscape have contributed to the devaluation of these properties.

Implications for the Metaverse Property Market

The depreciation of popular metaverse properties has significant implications for the overall metaverse property market. Investors are growing increasingly cautious as they witness the decline in value, leading to risk aversion. Questions are being raised about the long-term stability and investment potential of virtual real estate. However, some experts remain optimistic, highlighting the potential for property value recovery and the influence of tech giants on the future of the metaverse property market.

Balancing Risks and Opportunities

Investing in the metaverse property market requires a careful evaluation of risks and opportunities. While caution is advised, there are still promising projects within the metaverse that offer potential returns. Diversification and thorough research are crucial for mitigating risks and maximizing investment outcomes in this evolving market. Understanding the dynamics of the metaverse property market, identifying promising projects, and staying informed about the latest trends are essential for investors seeking to navigate this emerging landscape successfully.

Future Outlook and the Role of Tech Giants

Despite the current challenges, the metaverse property market continues to evolve. Tech giants and major economies are actively testing the potential of the metaverse through various investments and initiatives. Apple, for instance, is set to release a mixed-reality headset, which could reignite global interest in the metaverse. The launch of innovative products by influential companies like Apple often has a significant impact on markets. Experts suggest that Apple’s entry into the metaverse space may bring renewed attention and potential value to metaverse properties.

The Importance of Cybersecurity and Education

As the metaverse expands and attracts more users, the need for cybersecurity education becomes crucial. CyberDefender, a pioneer in metaverse cybersecurity education, aims to raise awareness and promote digital safety within virtual environments. The integration of metaverse platforms for cybersecurity education marks an emerging trend that could shape the future of digital safety. By utilizing immersive experiences and interactive learning, CyberDefender aims to equip individuals with the knowledge and skills necessary to navigate the metaverse securely.

Conclusion

The depreciation of popular metaverse properties such as Otherdeeds, The Sandbox, Decentraland, Somnium, and Voxels highlights the volatility and risks inherent in the metaverse property market. While the current decline in value raises concerns, it also presents opportunities for investors who approach the market with caution and strategic foresight. As the metaverse continues to evolve, it is crucial for individuals to stay informed about market trends, evaluate investment options carefully, and embrace the potential of this burgeoning virtual realm.