The Metaverse market crash has resulted in heavy losses for some investors. After the initial FOMO, bitter disappointment set in after more than 92% price losses for some of the largest projects. But what do the latest figures tell us about the current status of the Metaverse? Which developments are currently in the offing and can they still help to achieve a breakthrough? Are there possibly even particularly cheap buying opportunities right now? Read the following post now to make more informed decisions and not miss any possible chance!

What is the Metaverse?

The Metaverse is a concept of a persistent, online, 3D universe that combines multiple different virtual spaces. You can think of it as a future iteration of the internet. The metaverse will allow users to work, meet, game, and socialize together in these 3D spaces.

The metaverse isn’t fully in existence, but some platforms contain metaverse-like elements. Video games currently provide the closest metaverse experience on offer. Developers have pushed the boundaries of what a game is by hosting in-game events and creating virtual economies.

Although not required, cryptocurrencies can be a great fit for a metaverse. They allow for the creation of a digital economy with different types of utility tokens and virtual collectibles (NFTs). The metaverse would also benefit from the use of crypto wallets, such as Trust Wallet and MetaMask. Also, blockchain technology can provide transparent and reliable governance systems.

Blockchain, metaverse-like applications already exist and provide people with liveable incomes. Axie Infinity is one play-to-earn game that many users play to support their income.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

The Metaverse in a State of Turmoil?

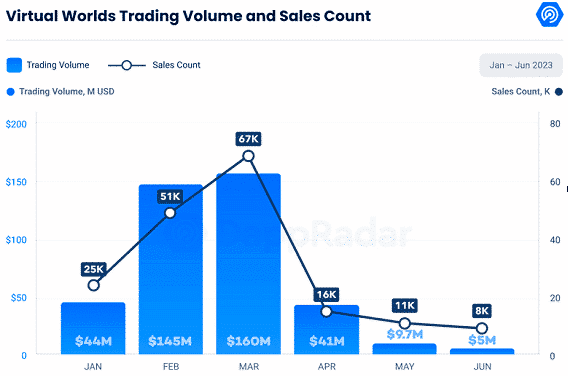

In the fast-evolving digital landscape of 2023, the virtual world market started the year at a remarkable pace. During the first quarter, there was a surprising increase in trading volume for digital properties, increasing by a staggering 277%. According to data provided by DappRadar, the total trade reached an impressive $311 million. However, the second quarter saw a dramatic downturn, with trading volume falling 81 percent to just $56 million.

The decline in commercial activity was reflected by a 75% drop in land sales, which fell to 35,522. The main reason behind this reversal of fortune was the attention of users toward the rapidly emerging trends of meme coins and de-fi services. These alternative areas within the blockchain ecosystem gained significant interest, resulting in a significant decrease in trading activity within the metaverse sector.

Despite the overall downturn, Otherdeed for Otherside managed to maintain its leading position among the top virtual apps, although its trading volume dropped significantly by 84.86% to $44.5 million. Despite the downturn, the second quarter proved to be a critical period for the Yoga Labs ecosystem.

Sandbox and Decentraland, ranked third and fourth respectively, experienced notable events and contributions during the second quarter. Despite the bullish sentiment around these platforms, land sales volume declined by 44% and 66%, respectively.

Additionally, the recent lawsuits filed by the Securities and Exchange Commission (SEC) against prominent cryptocurrency exchanges Binance and Coinbase had a severe impact on the respective tokens, SAND and MANA, sending their value to their all-time highs. dropped below 92%. ATH). The regulatory action shook investor confidence and further contributed to the downward spiral of the metaverse sector.

These challenging developments have put the Metaverse in a state of turmoil, prompting stakeholders and industry participants to reassess strategies and seek avenues for revitalization. It remains to be seen how the market will evolve in the coming months and whether Metaverse can regain its previous momentum in the dynamic landscape of the digital age.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

Invest early in the revolutionary VR metaverse!

Virtual land prices hit historic lows.

Virtual real estate prices have recently reached historic lows, signaling a significant shift in the dynamic landscape of the Metaverse. The virtual real estate market has been subject to notable fluctuations, with the peak of land prices occurring in 2022. However, the year 2023 has witnessed a considerable transformation in the market.

Several factors have contributed to the changing market conditions within the Metaverse. The burgeoning hype around meme coins and the proliferation of decentralized finance (DeFi) services have diverted user interest away from virtual worlds. Additionally, the lawsuits filed by the U.S. Securities and Exchange Commission (SEC) against major cryptocurrency exchanges, such as Binance and Coinbase, have had a profound impact on the overall sentiment and engagement of users in the Metaverse.

These influences are evident in the decline of both the base prices and trading volume of Metaverse properties throughout 2023. Notably, The Sandbox, a prominent virtual world, experienced a staggering 85.19% decrease in prices, followed by a 94.91% decline in Decentraland’s value. Similarly, Otherdeed for Otherside witnessed an 86% drop in prices. While the SEC lawsuits likely affected the prices of SAND (The Sandbox’s native token) and MANA (Decentraland’s native token), it is important to note that other metaverses also encountered similar developments.

The convergence of various factors has created a unique market environment, characterized by lower virtual land prices and reduced trading activity. As the Metaverse continues to evolve, it remains to be seen how these dynamics will influence the future of virtual real estate and shape investment strategies within this emerging digital realm.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

Invest now in a unique business metaverse!

Is Falling Investment in Metaverse Startups a Sign of the End?

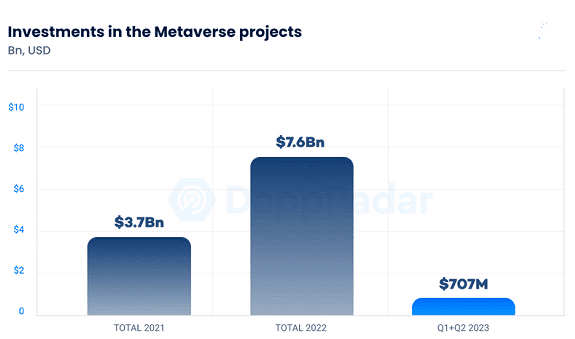

The Metaverse industry has also seen a significant decrease in funding, down 66% from 2022. Despite this, the industry has attracted an impressive $707 million since the start of 2023. In 2022, infrastructure projects accounted for the largest share of funding with a 33.47% dominance, while metaverse projects only came in at 27.32%.

Despite the seeming abatement of the Metaverse funding hype, the future is far from bleak. The industry continues to attract significant investment as it is expected to grow from $416.02 billion in 2023 to a staggering $3,409.29 billion by 2027. That’s an incredible 69.2% compound annual growth rate (CAGR).

Companies like Animoca continue to support Metaverse startups and have invested in more than 20 companies pushing the boundaries of the Metaverse over the past six months. Despite the current challenges, continued funding and development point to an exciting future for the Metaverse.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

Future Prospects for the Metaverse

In addition, the virtual reality (VR) world took another step forward when Apple introduced its new VR headset, the Apple Vision Pro. This stylish $3,500 device aims to redefine our virtual interactions and shape the future of the Metaverse.

The arrival of the Apple Vision Pro is a game changer not only for Apple but for other companies in the Metaverse ecosystem as well. Unity, a prominent game development platform, saw its shares surge 17% after announcing Apple’s VR set. Disney also saw its stock value rise when it announced that its Disney+ streaming service would be compatible with the Vision Pro. But SAND, MANA, APE, and VR were also able to benefit from the news, at least in the short term.

The Metaverse is rapidly changing from a sci-fi fantasy into a tangible, tactile, virtual reality just like the blockchain games. At the forefront of this revolution are Asian countries leading the way with innovative platforms like Roblox, Decentraland, Fortnite, Sandbox, and Zepeto. As technology continues to evolve, the Metaverse is expected to have a significant impact on Asia’s GDP, which is estimated to reach between $800 billion and $1.4 trillion annually by 2035. Hong Kong, China, and Japan are at the forefront. Step into the future of fashion and immerse yourself in the Metaverse like never before! With the Metasuit, we’re revolutionizing the way you experience virtual worlds by combining cutting-edge technology with stylish, hybrid fabrics.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

Invest now in a special virtual working world!

Metaverse Market Growth Dynamics

Driver: Growth in demand in the entertainment and gaming industry

The global media and entertainment and gaming industry has seen the fastest growth due to the adoption of AR, VR, and MR technologies. The main reasons for adopting these technologies are that devices, such as VR headsets, MR headsets, HUDs, HMDs, smart glasses, and smart helmets, can offer a first-person perspective, acting as a natural user interface. can provide 6 degrees of freedom, etc., to create realistic-looking virtual scenarios to enhance the overall gaming experience of end users.

Due to the introduction of these devices and the solutions offered, user experiences have increased manifold. Virtual user experience in real-time scenarios is the best presentation technology can provide to mankind. The growing demand for augmented reality devices has also attracted significant investments by key market players. Increasing investments and developments by key market players are expected to boost the adoption of Metaverse in gaming and entertainment.

Cons: High installation and maintenance costs of advanced Metaverse components

Metaverse hardware includes XR devices, semiconductor components, sensors, trackers, and other cutting-edge devices. To experience the metaverse in a realistic and immersive way, fast networking, sufficient storage, and high-end hardware are required, which are expensive. The devices used in Metaverse also use 3D and other advanced technologies to create realistic-looking virtual environments, making their prices much higher.

Enterprise-grade Metaverse software such as engines, 3D modeling software, and rendering tools are expensive. In addition, the installation of augmented reality devices and solutions requires additional costs. Their maintenance costs further add to the overall investment needed to adopt this technology. Hence, such high installation and maintenance costs will restrain the growth of the Metaverse market globally.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

Opportunity: Inclusion of Metaverse and related technologies in the aerospace and defense sector

Technologies, such as XR, AI, and analytics in the aerospace and defense sector are expected to be useful for training and simulation applications to a large extent. These technologies combined with Metaverse are expected to be helpful for experimental training using real-time data-driven applications. Thus, Metaverse is enabling better and more efficient transfer of the right skills and better knowledge retention by the trainees in this vertical/enterprise.

Augmented reality is used to train ground crews for pre-flight checks in airlines. It is also used to allow the ground crew to carry out required procedures before the aircraft takes off. Further, shared technologies can be used to inspect aircraft before take-off, analyze data, and detect faults, thereby ensuring increased safety. Metaverse, in integration with XR, can also assist in weapons training, flight training, and simulation practices, thereby promoting market growth.

Challenge: Result of global economic slowdown due to COVID-19

The ongoing pandemic has increased the demand for augmented reality devices due to unexpected lockdowns in critical regions (Europe, Asia Pacific, and North America). Employees of many organizations are working from home in the wake of COVID-19, thus increasing the need for virtual meetings, training, and conferences. The pandemic has also affected the global manufacturing of augmented reality devices.

A 2020 survey of the manufacturing industry in the US by the National Association of Manufacturers (NAM) showed that more than 35 percent of respondents believe that COVID-19 has affected their supply chain operations. is, and more than 53 percent is expected. Changes in their work in the coming months.

Some major industrial companies have closed their facilities and are considering a range of layoffs to prevent the spread of the virus and for economic reasons. The severe impact of the pandemic on the manufacturing industry has halted the supply of augmented reality devices across the globe. This has reduced consumer spending on non-essential items. Consequently, it is expected to act as a challenge to the growth of the Metaverse market in the short term.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

On the basis of components, the software segment holds the largest market size during the forecast period.

The software market is dominated by augmented reality software. The high share is attributed to the high demand for AR and VR web app development tools, AR and VR mobile app development tools, AR and VR studios, software development kits (SDK), and cloud-based tools. Additionally, 3D mapping, modeling, and reconstruction tools, and volumetric video tools are key components for designing virtual worlds and games in Metaverse platforms.

The software market for metaverse platforms is growing at the highest rate due to the emergence of centralized and decentralized gateways, avatar identity generators, play-to-earn games, virtual worlds, and metaverse-based social media. The market for metaverse and financial platforms is dominated by a number of startups and is an emerging market with high potential for fast-growing technologies, such as blockchain, NFT, cryptocurrency, and virtualization. Companies are focusing on leveraging these technologies to design their own platforms and decentralized solutions.

The hardware market is expected to grow at the highest CAGR during the forecast period. The introduction of HUD in the entertainment sector will boost the growth of the AR devices segment of the market. The ability of AR devices to connect the real world with virtual objects has increased their demand in various applications.

Currently, AR smart glasses have the highest demand among AR devices in industrial applications, thus contributing to the growth of the AR devices segment. Haptics and gesture-tracking devices have been an integral part of VR hardware due to the increased use of consumer applications. Gaming with gesture-tracking devices gives users a better experience of the virtual world. The MR devices segment is mainly dominated by Microsoft HoloLens 2 and Magic Lap One, which are expected to gain popularity in the Metaverse experience.

On the basis of verticals, the consumer segment holds the largest market share among verticals during the forecast period

The consumer segment mainly consists of two sub-segments namely gaming and social media, and live entertainment and other events. Various entertainment applications include museums (archaeology), theme parks, art galleries, and exhibitions. Metaverse, with XR technology, offers remarkable results in terms of visual effects when used in gaming and sports broadcasting.

The gaming sector has been an early adopter of new technologies such as 3D, VR, and MR. These technologies can enhance players’ gaming experience by creating virtual objects and characters, which are linked to defined locations in the real world. Players can interact and get involved in real-time in these games and the engine and 3D modeling software are designed so accurately that it feels like live gaming to a player. Live entertainment and events include sports, circuses, music concerts, and other events such as trade fairs, exhibitions, seminars, etc.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

Fueling the Metaverse Revolution in 2023: Unveiling the $707 Million Investment

Despite a significant slowdown in the virtual world market and a steep fall in Metaverse land prices, the Metaverse industry has attracted substantial investment in 2023. According to a recent report by DappRadar, venture capital funds have invested $707 million in Metaverse projects this year.

The report highlights a sharp decline in trade volume in Q2 2023, falling 81% to $56M due to shifting interests toward AI, memes, and DeFi services. This has led to a decrease in the trading volume of top virtual apps such as Otherdeed for Otherside and Topia.

Another notable development is the introduction of Token Bound Accounts (ERC-6551), which is set to revolutionize the way we interact with NFTs. ERC-6551 allows every NFT to own Ethereum (ETH) and other ERC-20, 721, and 1155 tokens, opening the way for many use cases previously inaccessible or implemented on-chain. It was difficult to import.

The report also highlights Asia’s potential to dominate the metaverse market, with its GDP expected to grow to $1.4 trillion by 2035. Countries or regions such as Hong Kong, mainland China, and Japan are leveraging Metaverse as a strategic asset for their digital. Future.

In the face of these challenges, companies like Animoca Brands are still making significant investments in metaverse startups, indicating a promising future for the industry. Despite the current market downturn, this continued funding and growth points to an exciting future in the Metaverse space.

77% of retail CFD accounts lose money. Cryptoassets are a highly volatile, unregulated investment product without EU investor protection. Your capital is at risk.

Conclusion

The ongoing evolution of digital technologies, particularly Virtual Reality (VR) and the metaverse, is reshaping our world and economy in groundbreaking ways. Apple’s introduction of the Apple VR Pro has the potential to make VR technology mainstream, driven by innovative features that aim to enhance user interaction in the virtual world. Concurrently, the rise of decentralized identity solutions and AI technology marks an era of heightened digital security and efficient, user-friendly digital environments.

Asia, as a key player in this digital transformation, is set to reap immense benefits from the metaverse, estimated to boost the region’s GDP by up to $1.4 trillion by 2035. Countries such as China, Japan, and Hong Kong are leveraging their unique strengths to harness the potential of the metaverse, thereby enhancing economic growth and digital innovation.